Community website by MBC/Ernest Abrams. Call 808-739-9797 for advertising/sponsorship.

Waikiki Get Down - Honolulu, Hawaii

News Item- Powered by MBC NewsMaker

City Sends 2022 Real Property Notice Of Assessments

- Tweet

HONOLULU - The City and County of Honolulu’s Real Property Assessment Division has prepared the 2022 real property notice of assessments applicable to the 2022-23 tax year. On or before December 15, 2021 the City will distribute approximately 302,000 notices via the United States Postal Service or by email (for those who have subscribed to electronic delivery).

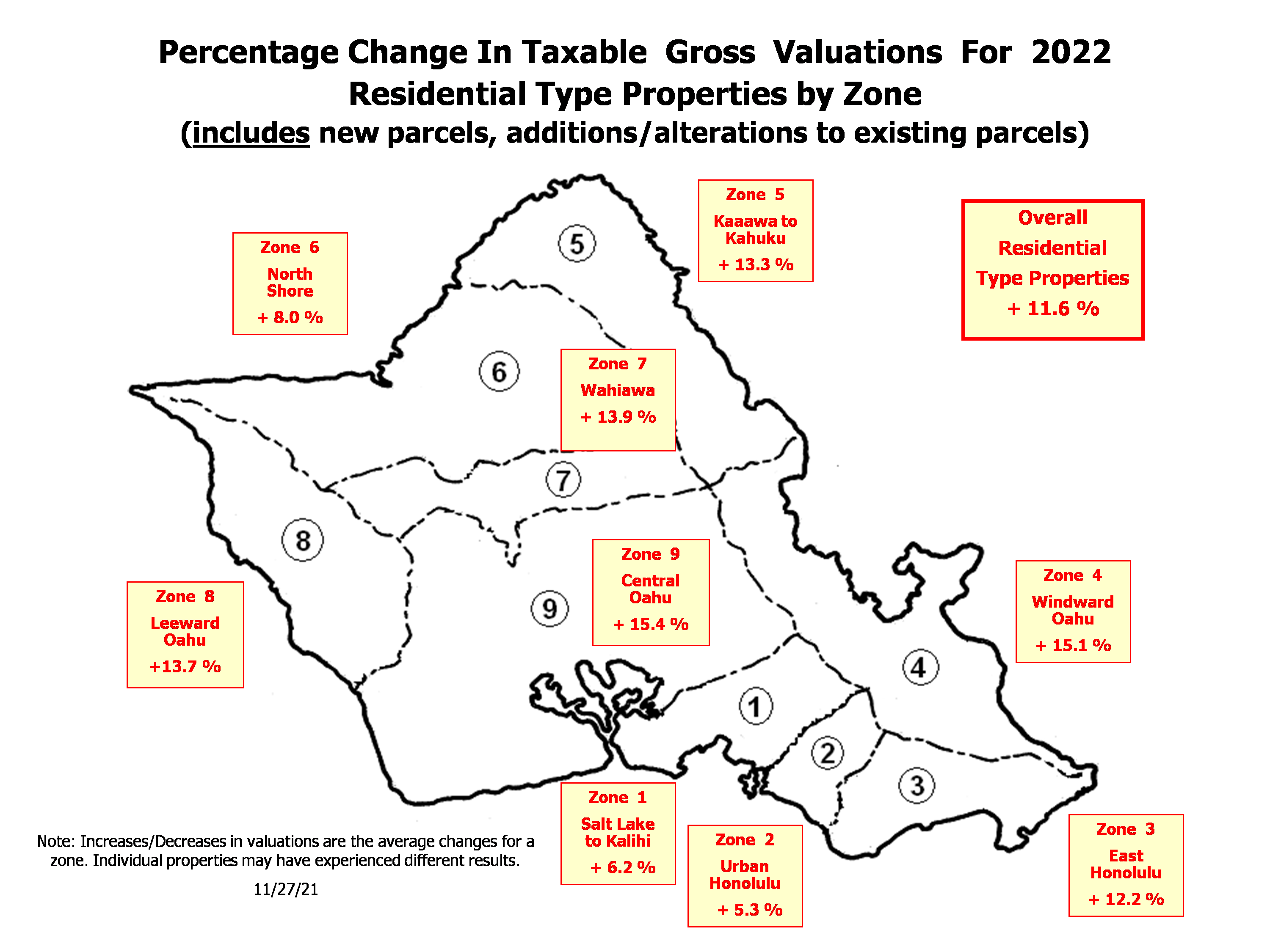

The aggregate assessed valuation of all real property on O‘ahu increased from $279.29 billion to $305.79 billion, indicating an approximate increase of 9.5 percent. Assessed values of the Residential classification increased from $195.18 billion to $211.24 billion, indicating an approximate increase of 8.2 percent. The Residential A class increased from $24.22 billion to $33.66 billion, an increase of 39.0 percent. The Hotel and Resort class increased by 3.5 percent. The Commercial class decreased by 0.1 percent, and the Industrial class increased by 3.0 percent. These percentages represent island-wide classification totals and may not reflect an individual property or a specific neighborhood value change.

The notice of assessment is not a tax bill. The notice provides the property’s ID/Tax Map Key, assessed value, tax classification, applied exemption amount, applicable special assessment, and net taxable value. All 2022 assessed values reflect the value of real property in their entirety (fee simple) as of October 1, 2021, and are derived from sales of similar property through June 30, 2021.

Information stated on the Real Property Notice of Assessment is used to determine the real property tax bill amount. The property’s net taxable value stated on the assessment notice is taxed per $1,000 of value at the property’s applicable classification tax rate. The classification tax rate is set by the City Council in June 2022. The tax bill will be mailed in July 2022.

Property owners should call the Appeal Hotline at (808) 768-7000 from December 15, 2021 through January 14, 2022, during the business hours of 7:45 a.m. and 4:30 p.m. HST for assistance with any questions. Inquiries may also be submitted via email to bfsrpmailbox@honolulu.gov.

Property owners who wish to dispute their real property assessment may file an appeal during the period of December 15, 2021 to January 15, 2022. Hand delivered appeals must be received and accepted by 4:30 p.m. on January 14, 2022. If the appeal is mailed, it must be postmarked on or before January 15, 2022. Appeals filed online at realpropertyhonolulu.com must be completed and submitted by 11:50 p.m., January 15, 2022. A $50.00 deposit for each appeal is required. Make checks payable to City and County of Honolulu. Enclose a self-addressed stamped envelope with your appeal application to receive a receipted copy of the appeal. An appeal cannot be lodged by facsimile transmission or via email.

In an effort to expedite the appeal process and to minimize the wait time for a Board of Review hearing date, appellants should submit any evidence and supporting documentation to the Real Property Assessment Division with the appeal form or shortly thereafter. If you are submitting evidence separately from the appeal form, please include the name of the appellant, Parcel ID/TMK, year of the appeal, and contact information such as phone number, mailing address, and email address to either office.

Visit realpropertyhonolulu.com for links to search real property records, pay property taxes electronically, file a home exemption claim, report exemption status changes, file an appeal to the Board of Review, and download forms. Property owners may also register to receive their real property assessment notices via email. Property owners who reside in their property are encouraged to file a home exemption claim, if they have not already done so.

Property owners who have not received their 2022 Assessment Notice by December 31, 2021, are advised to call (808) 768-7000 or visit an office at:

Real Property Assessment Division

Real Property Assessment Division

842 Bethel Street, Basement

1000 Uluohia Street, #206

Honolulu, HI 96813

Kapolei, HI 96707

Questions? Ready for an appointment?

Featured Product/Service

- RELATED LINKS

Calendar

Check out things to do in Waikiki, Hawaii on the calendar of events.News and Newsletters

Keep up with the latest news and happenings in the Waikiki, Hawaii community.Waikiki, Hawaii Featured Pages

View our directory of feature pages showcasing all the great things Waikiki has to offer.Featured Sponsors Offers

Great offers from our sponsors who support the Waikiki, Hawaii Community More...Waikiki, Hawaii Coupons & Discounts

Save money in Waikiki, Hawaii with these coupons.About Waikiki - Honolulu Hawaii

Learn about Waikiki, Hawaii.About Waikiki Get Down.com

Learn about WaikikiGetDown.com website and its creator.

Please send questions about this website to

Copyright© 2012 - 2021 WaikikiGetDown.com. All rights reserved.

Terms of Use / Legal Disclaimer / Privacy Statement

Site Designed and Managed by MacBusiness Consulting

Terms of Use / Legal Disclaimer / Privacy Statement

Site Designed and Managed by MacBusiness Consulting